Have you ever stopped to wonder who truly looks out for your money when you put it into stocks or other kinds of investments? It's a big question, especially with all the different ways people can put their savings to work these days. Well, there's a group, a kind of watchdog, that helps keep an eye on things, making sure the people who handle your investment accounts play by the rules. This organization helps make the financial world a safer place for everyday folks like you and me, which is pretty important, really.

This group works behind the scenes, you know, to make sure the whole investment game stays honest and fair. They're involved in lots of different things, from setting down the basic guidelines for how brokers should act to making sure those guidelines are actually followed. They even provide ways for people to sort out disagreements if something goes wrong with their investment professional, which can be a real comfort, in a way. It's all about making sure the money you've worked hard for is looked after.

So, if you've ever felt a bit unsure about the investment world, or just curious about who's keeping an eye on it all, you're in the right spot. We're going to talk about the Financial Industry Regulatory Authority, often called FINRA, and what they do to help keep your financial future a little more secure. It's actually quite interesting how they manage to cover so much ground to help people feel more confident about their money decisions.

- Adventhealth Winter Park

- Wilkes Barre Scranton International Airport Wilkes Barre Scranton Pennsylvania

- Funny Bone Omaha

- Irvington Hs Fremont

- Family Credit Management

Table of Contents

- Who is the Financial Industry Regulatory Authority?

- How Does the Financial Industry Regulatory Authority Keep Things Fair?

- What if You Have a Problem with Your Broker?

- Where Can You Get Help or Learn More?

Who is the Financial Industry Regulatory Authority?

The Financial Industry Regulatory Authority, or FINRA as most people call it, acts like a watchful guardian for investors in the United States. Basically, their main job is to keep an eye on the people who help you buy and sell investments, those folks known as brokers. They do this to help keep your money safe and make sure the whole investment world operates with honesty. It's a pretty big task, you know, considering how many people are involved in buying and selling things like stocks and bonds every single day.

They have a few core ways they go about this important work. For one thing, they create the guidelines that investment professionals need to follow. Then, they make sure those guidelines are actually followed, and if something looks off, they look into it. This means they are involved in making rules, making sure people stick to those rules, and doing investigations when necessary. So, they're not just making suggestions; they're actively working to maintain a fair playing field for everyone, which is, in some respects, quite reassuring.

It's interesting to note that FINRA works alongside another big player, the Securities and Exchange Commission, often called the SEC. Together, these two organizations help oversee the entire US financial market. While they both aim for investor safety, they each have their own distinct areas they focus on and different powers they can use. So, you might say they're like two parts of a team, each with a slightly different role but with the same goal: protecting your financial well-being. This setup, you know, helps provide a broader coverage for the market.

The history of this kind of oversight goes back quite a ways, even to the time of the Great Depression. That period really showed how much a good system was needed to protect people's savings. Over the years, the ways this protection happens have changed and grown, but the basic idea of keeping investors safe has always been at the heart of it. It's a long story, but the roots of the Financial Industry Regulatory Authority are quite deep in the need for a safer investment environment, which is something many people appreciate.

How Does the Financial Industry Regulatory Authority Keep Things Fair?

You might wonder how an organization like the Financial Industry Regulatory Authority actually goes about making sure the investment world stays honest and fair. Well, they have several key ways they approach this, and it involves a lot more than just waiting for something to go wrong. They're very active in setting the stage for good behavior and checking that everyone is playing by the established guidelines. This proactive approach is, arguably, what makes a real difference in the day-to-day operations of the market.

One of the main things they do is provide various services to help protect people who put their money into investments and to help keep the market honest. This includes giving out information, offering learning opportunities, making sure rules are followed, and providing ways to settle disagreements. It’s a pretty comprehensive approach, you know, covering many different angles to ensure that the investment experience is as smooth and trustworthy as it can be for ordinary people. They really do try to cover all the bases.

Setting the Rules for the Financial Industry Regulatory Authority

A big part of how the Financial Industry Regulatory Authority helps keep things fair is by creating the rules that investment firms and brokers must follow. These aren't just suggestions; they are serious guidelines that help shape how the entire market operates. They put these rules into a collection, almost like a big rulebook, that everyone in the business needs to know and follow. This means that when you're dealing with an investment professional, there are already clear expectations for how they should conduct themselves, which gives you a certain level of protection, you know.

Beyond just writing these guidelines, FINRA also makes sure they are put into action. This involves watching what happens in the market and making sure that firms and individuals are sticking to what's expected of them. If they see something that doesn't look right, they have the power to look into it and take action. So, it's not just about having rules on paper; it's about actively seeing that those rules are respected and followed by everyone involved in the buying and selling of investments. This helps maintain the overall honesty of the market, which is pretty important.

They also offer ways for firms to get in touch with them about these rules. For instance, they have a program where firms can reach out with questions about the guidelines, when certain paperwork is due, and where to find help with following all the requirements. This helps make sure that firms have the support they need to understand and follow the rules, which ultimately helps protect investors. It’s a system designed to encourage good behavior from the start, rather than just reacting when things go wrong, which is actually quite smart.

Checking Up on Firms with the Financial Industry Regulatory Authority

Another way the Financial Industry Regulatory Authority helps keep the market fair is by regularly checking on the companies that are part of their group. They actually examine these firms to make sure they are operating properly and following all the established rules. This kind of oversight is a key piece of investor protection, as it helps catch potential problems before they become bigger issues for people's savings. It’s a bit like having a regular check-up for the investment world, you know, to ensure everything is running smoothly.

They also keep a close watch on what happens in the markets. This means they are constantly monitoring trading activity and other events to spot anything that might be out of the ordinary or potentially harmful to investors. This ongoing observation helps them react quickly if there's a problem and helps keep the overall integrity of the places where money is traded. So, it's not just about making rules; it's also about being present and watchful in the daily flow of financial activities, which is, in a way, very reassuring for investors.

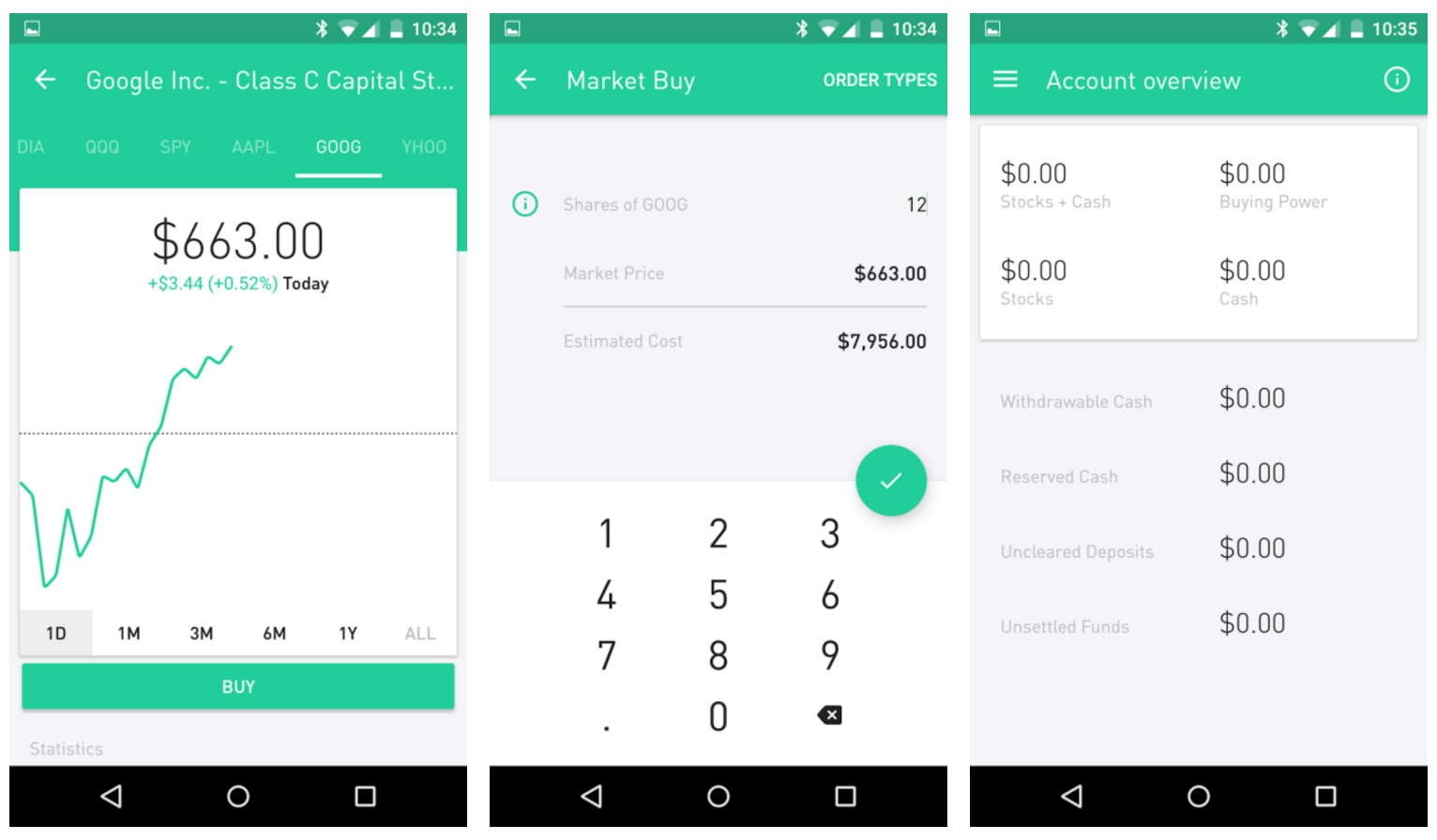

Beyond checking on firms, FINRA also plays a part in making sure the people who want to become investment professionals are ready for the job. They actually conduct the tests that aspiring securities professionals need to pass before they can start working with people's money. This helps ensure that the folks giving investment advice or handling trades have a certain level of knowledge and understanding. It’s a foundational step in keeping the quality of service high and, consequently, protecting investors from those who might not be fully prepared, which is pretty essential.

What if You Have a Problem with Your Broker?

Even with all the rules and oversight, sometimes things can still go wrong, or you might have a disagreement with your investment professional. It's a natural part of any relationship, really, and the Financial Industry Regulatory Authority has ways to help people sort out these kinds of issues. They understand that not every interaction will be perfect, and they provide avenues for investors to address their concerns without necessarily having to go to court, which can be a lengthy and expensive process, you know.

Sorting Out Disagreements Through the Financial Industry Regulatory Authority

One of the key ways FINRA helps resolve problems is through what they call dispute resolution. This includes two main methods: arbitration and mediation. These are both ways for people to work out disagreements with their brokers or investment firms outside of a traditional courtroom setting. Arbitration involves a neutral third party who hears both sides of the story and then makes a decision, which is usually binding. Mediation, on the other hand, involves a neutral third party who helps both sides talk through their issues and try to find a solution they can both agree on. It's a more collaborative approach, in some respects.

These methods are designed to be more accessible and often quicker than going to court. For example, if you're going through arbitration, and you're facing some financial difficulties, you might even be able to ask for a waiver of certain fees involved in the process. This helps make sure that people aren't prevented from seeking a resolution just because of money troubles. It's about trying to make the process as fair and available as possible for everyone involved, which is actually quite thoughtful.

Telling the Financial Industry Regulatory Authority About Concerns

If you ever suspect that something dishonest or questionable might be happening with your investments, or if you just have a serious concern about your broker, the Financial Industry Regulatory Authority has a place where you can report it. They have an investor complaint center, and you can file a complaint there. This is a really important tool for investors, as it allows them to bring potential problems to the attention of the people who can do something about it. So, if something feels off, you know there's a place to go.

What's quite helpful is that you can file a complaint even if you are already in the middle of trying to sort things out through arbitration or mediation. This means that if you're already trying one method to resolve a problem, you can still let FINRA know about your concerns. It provides an extra layer of oversight and ensures that your issues are heard, even if they are being addressed through another process. This ability to report is, arguably, a very important part of keeping the market honest and making sure bad actors are held accountable.

Where Can You Get Help or Learn More?

The Financial Industry Regulatory Authority doesn't just focus on rules and enforcement; they also put a lot of effort into helping investors learn and find the resources they need. They understand that a well-informed investor is a better protected investor, so they offer various ways for people to gain knowledge and get assistance. It's about empowering people to make smart choices with their money, which is pretty valuable, really, for anyone dealing with investments.

Learning About Money with the Financial Industry Regulatory Authority

One notable way FINRA supports investors is through its Investor Education Foundation, which was started in 2003. This foundation has a clear mission: to give people in America the knowledge, the practical skills, and the right tools to make sensible financial choices throughout their lives. It's all about helping individuals feel more confident and capable when it comes to handling their money, from saving for retirement to managing everyday expenses. This educational aspect is, in a way, just as important as the regulatory side, as it helps prevent problems before they even start.

They also offer other resources to help people learn. For instance, they provide something called BrokerCheck. This tool allows you to look up information about brokers and investment firms. You can see their professional background, their qualifications, and any past complaints or disciplinary actions. It’s a really helpful way to do your homework before you decide to work with someone, or even just to check up on someone you’re already working with. Knowing who you're dealing with is, you know, a very important step in protecting your money.

Getting Assistance from the Financial Industry Regulatory Authority

If you have questions about rules, or need help finding certain information, the Financial Industry Regulatory Authority also provides specific points of contact. They have a program for regulatory contacts, which gives firms a way to ask questions about the rules, when things are due, and where to find help with following all the requirements. This helps firms stay on the right side of the rules, which ultimately benefits investors by ensuring the market operates fairly. It's about making sure everyone has access to the right information, which is pretty essential.

For smaller firms, they even have a dedicated helpline. If you're running a smaller investment business and you need help figuring out who the right person at FINRA is to talk to, or if you're having trouble with their online systems, or just have general questions, you can reach out to this helpline. It's a way to make sure that even the smaller players in the market have the support they need to operate correctly. This kind of accessibility is, you know, quite beneficial for the overall health of the financial community.

So, whether you're an investor looking for protection, someone with a concern about a broker, or just someone trying to learn more about how the financial world works, the Financial Industry Regulatory Authority is there with various services and resources. They gather information, provide learning opportunities, ensure rules are followed, and offer ways to settle disagreements to help keep investors safe and the market honest. They also work to improve investing for everyone, helping to make the market a place that feels fair and steady. Their team of dedicated and skilled people who are good at what they do in this business truly helps maintain the honesty of the market and looks out for people who invest their money.

Related Resources:

Detail Author:

- Name : Colt Padberg

- Username : tommie71

- Email : eve80@harber.net

- Birthdate : 1999-10-20

- Address : 56997 Reinger Courts Suite 579 Port Sandy, KS 08895

- Phone : +1 (423) 338-6990

- Company : Koelpin PLC

- Job : Roof Bolters Mining

- Bio : Pariatur quidem voluptatum ipsum omnis. Quos libero ea dolores dolor itaque. Porro porro ea tempora. Iure facere voluptatem et earum et nesciunt sed non.

Socials

linkedin:

- url : https://linkedin.com/in/elmiraschimmel

- username : elmiraschimmel

- bio : Sint est odio voluptates maiores.

- followers : 4817

- following : 2784

facebook:

- url : https://facebook.com/schimmel2022

- username : schimmel2022

- bio : Aliquid et laboriosam et eligendi aut.

- followers : 6127

- following : 2910

tiktok:

- url : https://tiktok.com/@elmira_real

- username : elmira_real

- bio : Omnis saepe et nemo earum non maxime quas. Modi ut impedit enim sit recusandae.

- followers : 3199

- following : 2250